Algorithmic trading is a method used by financial firms to automate trading strategies using sophisticated mathematical models. At CompKin, you can participate by setting up an account and choosing your preferred strategies.

Quantitative Trading Opportunity is Now

Algorithm Structure

Our algorithm structure ensures transparency, fairness, and superior performance. Join us in revolutionizing the financial markets.

We use :

- Advanced Machine Learning

- Big Data Analysis

- Real-Time Trading Algorithms

What Is Quantitative Trading?

Quantitative trading, or quant trading, is a method used by financial firms like CompKin to enhance market strategies and increase trading efficiency. By using algorithms, the company can generate precise trading signals.

Why is it necessary?

Quant trading serves several purposes, both for financial firms and investors. Here are some reasons why quant trading is utilized:

- Enhanced Decision Making

- Risk Management

- High-Speed Trading

- Market Efficiency

Create Account

To sign up, visit our platform, enter your details, and set a secure password.

Fund Account

To add funds, access your account and go to the funding section.

Start Trading!

To begin trading, simply log into your account and access the trading interface.

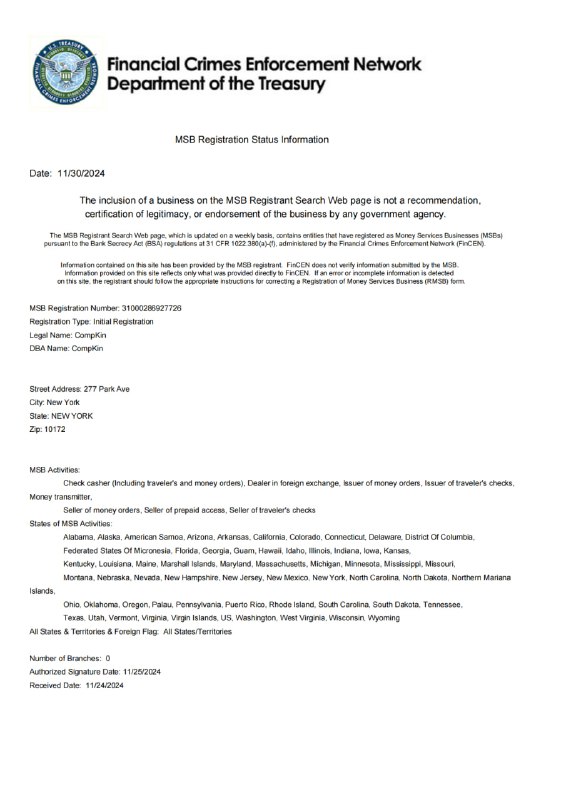

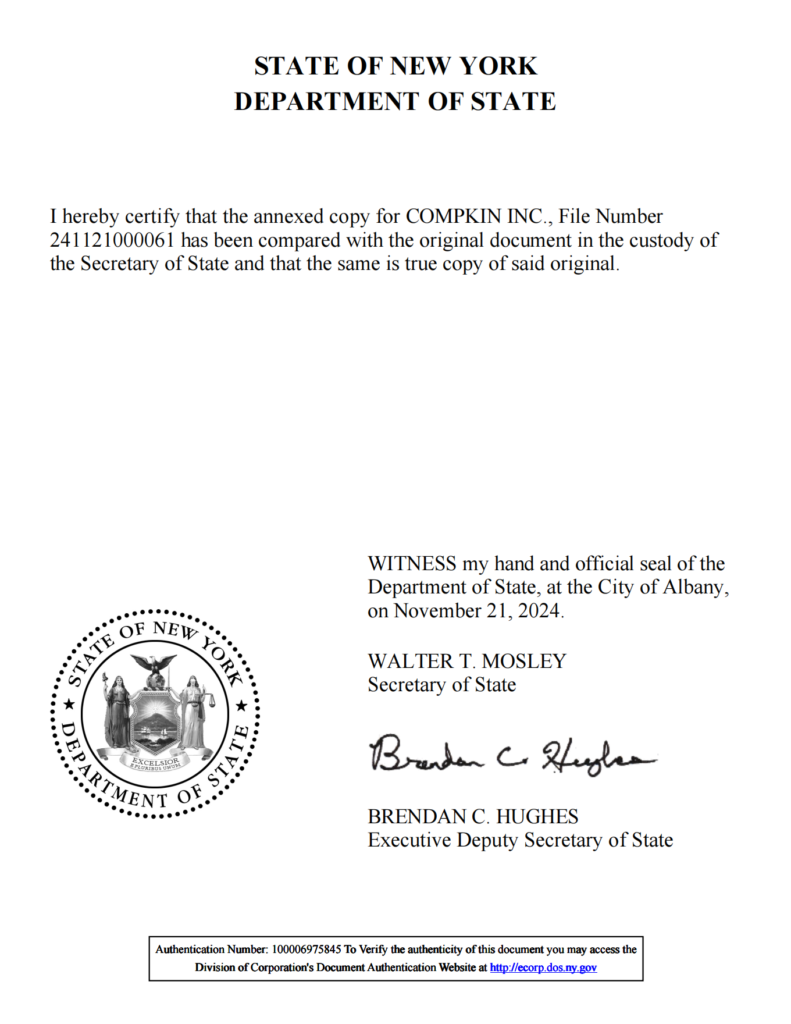

Our certificate

introduction to the cryco

tokenism

CompKin Resource Allocation

- Algorithm Research

- Operational Costs

- Technology Enhancement

- Liquidity Management

- Strategic Consultation

- Risk Mitigation

Allocation Of Resources From Algorithm Development

- Algorithm Research

- System Upgrades

- Risk Management

- Team Expansion

CompKin Governance Model

- Stakeholders

- Executive Team

- Research Analysts

- Technical Staff

- Advisory Council

Our Road map

Concept

- Strategic Vision

- Product Development Phases

- Team and Milestones

- Commitment to Transparency

Research

- Define Objectives

- Data Gathering

- Analyze Results

- Report Findings

Alpha Development

- Development Goals

- Set Up Development Environment

- Build Initial Models

- Refine and Test Models

Beta Release

- Criteria for Participation

- Prepare Beta Environment

- Collect User Feedback

- Implement Improvements

Final Implementation

- Finalize Product Specifications

- Launch Full-Scale Deployment

- Monitor Performance

- Continuous Enhancement

our great features

Advanced Algorithm Execution

Our platform has revolutionized the way we execute trades, offering precision and efficiency.

Robust Security Measures

Security and control over your investments are paramount, and with our platform, they are guaranteed.

Zero Transaction Fees

Experience the freedom of zero transaction fees with our platform.

Privacy Protection

Safeguarding your data is our top priority. With our platform, we employ state-of-the-art privacy measures.

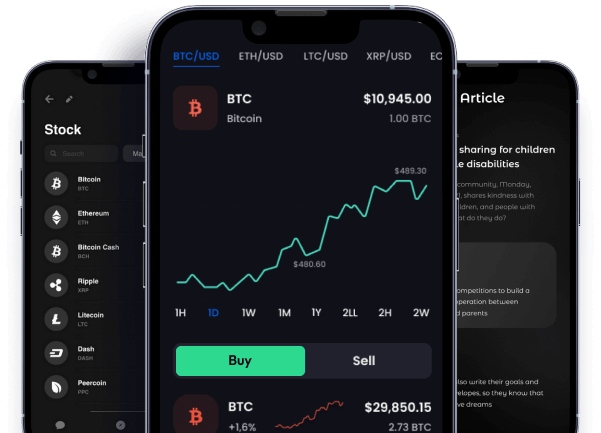

Mobile Quant Trading App 2.0 NEW

Everything you need in your smartphone: automated trading, algorithm adjustments, real-time market data. Our goal—optimize your trading experience.

- No limits on trading frequency or volume.

- Supports Apple Pay, Samsung Pay, Google Pay, QR code for seamless account funding.

- Contactless and secure trade execution.

- Integration with leading financial data providers and platforms.

Meet our team member

Have Any Questions?

-

How do I participate in algorithmic trading?

-

What is algorithmic trading?

Algorithmic trading involves using computer algorithms to trade securities based on predefined criteria automatically, without human intervention, aiming to generate profits at a speed and frequency that is impossible for a human trader.

-

What is the purpose of your algorithms?

Our algorithms are designed to analyze market data and execute trades at optimal times to maximize efficiency and profitability while minimizing risk.

-

What are the benefits of using your algorithms?

Using our algorithms provides speed, accuracy, and the ability to quickly react to market changes. They can also reduce the risk of manual errors and help diversify your trading strategies.

-

How are the algorithms developed?

Our team of expert developers and traders design and backtest our algorithms against historical data to ensure they perform well under various market conditions before they go live.

-

Is there a minimum investment requirement?

CompKin offers different investment options suitable for various budgets. However, a minimum investment may apply depending on the specific algorithmic strategy chosen.